Board Of Directors Innsbrook Owners Association, Inc.

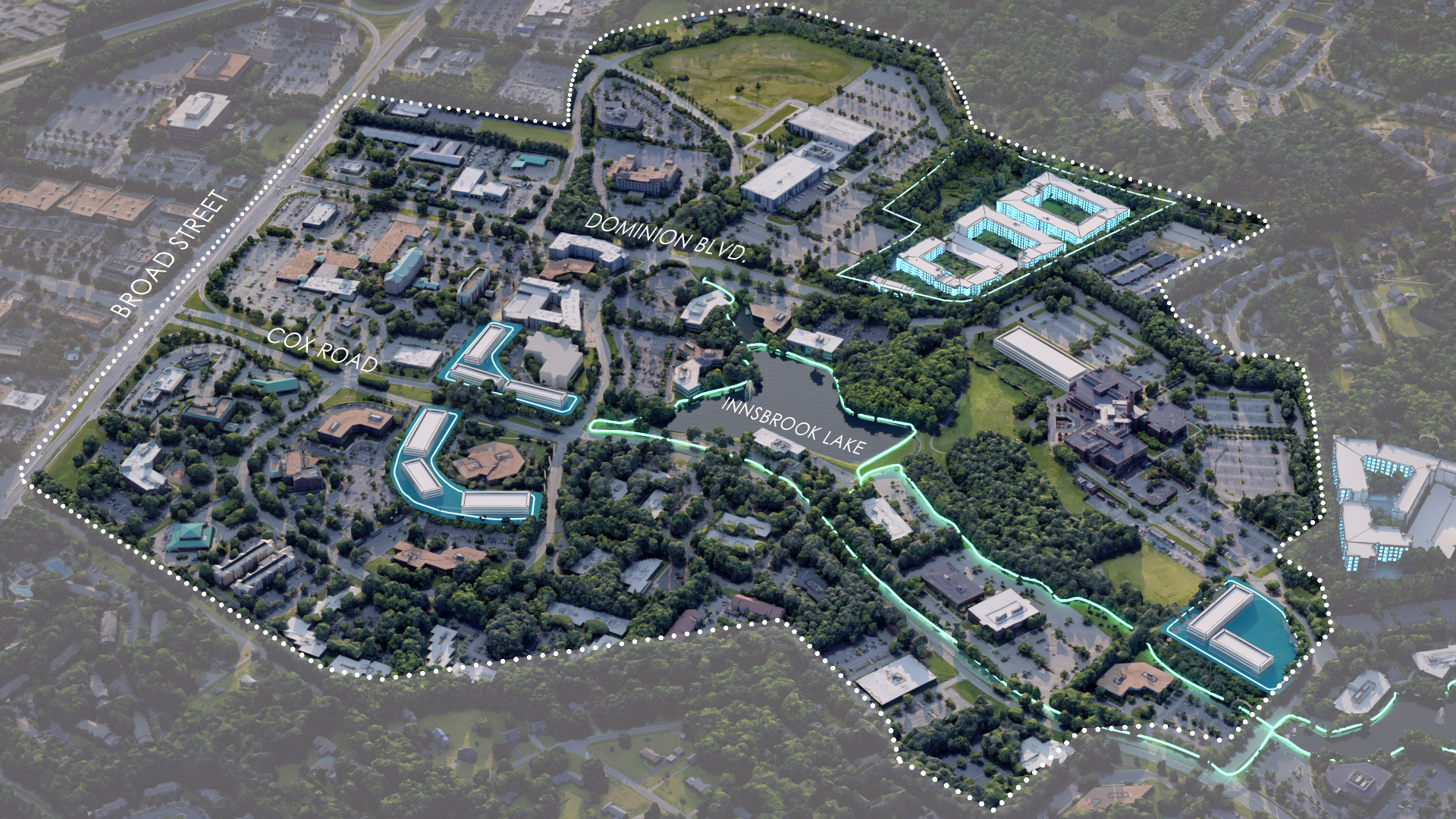

The Innsbrook Owners Association’s goal is to ensure the overall architectural harmony and enhance values for all those businesses within Innsbrook.

This shared vision of Innsbrook’s development quality has grown over the years. Innsbrook is equal to the size and scale of a small city, and the Innsbrook Owners Association’s Board provides the necessary oversight and management of its many amenities, grounds maintenance and daily operations, including property management services, architectural review, administration of association fees and overall park budget. Such vigilance in sound management practices continues to deliver the highest standards of quality within Innsbrook.

2024 IOA Meeting Schedule - Work Sessions

Meeting time: 11:30 AM -1:00 PM. – Subject to change or cancelation

Please note the time for the March meeting is 12 PM – 2 PM

January work session – CANCELED : n/a

2/14/2024 – February work session – OPEN : 4470 Cox Road

3/19/2024 – March work session – OPEN : 4470 Cox Road

4/10/2024 – April BOD Meeting – OPEN : 4470 Cox Road

5/15/2024 – Metropolis Phase 2 ARC Review Meeting, 11 am – 12 pm – Closed: 4470 Cox Road

6/12/2024 – June work session – OPEN : 4470 Cox Road

7/10/2024 – July BOD Meeting – OPEN : 4470 Cox Road

August – no meeting : n/a

9/11/2024 – Sept. work session – OPEN : 4470 Cox Road

10/9/2024 – Oct. BOD Meeting – OPEN : 4470 Cox Road

11/13/2024 – Nov. work session – OPEN : 4470 Cox Road

December – no meeting : n/a

2024 Architectural Review Meeting Schedule

Meeting time: 11:30 AM -1:00 PM. – Subject to change or cancelation

Please note the time for the March meeting is 10:30 am – 11:30 am

January work session – CANCELED : n/a

2/14/2024 – February work session – OPEN : 4470 Cox Road

3/19/2024 – March work session – OPEN : 4470 Cox Road

4/10/2024 – April BOD Meeting – OPEN : 4470 Cox Road

5/15/2024 – Metropolis Phase 2 ARC Review Meeting, 11 am – 12 pm – Closed: 4470 Cox Road

6/12/2024 – June work session – OPEN : 4470 Cox Road

7/10/2024 – July BOD Meeting – OPEN : 4470 Cox Road

August – no meeting : n/a

9/11/2024 – Sept. work session – OPEN : 4470 Cox Road

10/9/2024 – Oct. BOD Meeting – OPEN : 4470 Cox Road

11/13/2024 – Nov. work session – OPEN : 4470 Cox Road

December – no meeting : n/a

Funding For Operations and Reserve Fund

Annual Dues Assessment – General Operations

The annual dues assessments for General Operations are based on the Net Acreage for each property (defined as a tax parcel’s Gross Acreage less any Common Area, such as a portion of a lake). The revenue collected from the annual dues covers the general operations for the Innsbrook Corporate Park, which includes the following categories:

- Security (currently administered by Allied Universal Patrol at Innsbrook)

- Property Management Services for shared Common Areas

- Common Area Maintenance (Trail/Bridges/Infra Structure)

- Landscaping Management and Services for shared Common Areas

- Utilities for shared Common Areas (Electric/Water)

- Lake Management and Services

- Innsbrook (Brand Ambassador, Programs, Events, Marketing)

- Insurance (General Liability/D&O)

- Administration

(Accounting/Bank fees/Licenses/Legal/Consulting)

Annual Dues Assessment – Reserve Fund for Capital Improvements

The annual dues assessments for Reserve Fund for Capital Improvements are also based on the Net Acreage for each property (defined as a tax parcel’s Gross Acreage less any Common Area, such as a portion of a lake). The Reserve Fund was strategically established and adopted by the Board of Directors in order to proactively address ongoing capital improvement needs benefiting all constituents of the Innsbrook Corporate Center.

- Trail Renovations and Improvements

- Dredging of Lakes

- Monument Signage

- Bridge and Decking Improvements

- Stormwater Management

- Innsbrook After Hours Music Venue

Annual Dues Assessment Methodology (for both Operating and Capital Improvements)

Each December during the Annual Meeting, the Board of Directors recommends an annual operating budget for the upcoming Fiscal Year to cover Operations and Capital Improvements. The Property Owners vote at the Annual Meeting to approve the proposed budget.

For reference, the approved annual dues assessments for 2022 are as follows:

| Operation Fund: | Reserve Fund : |

| $1,386.00 per Net Acre | $451 per Net Acre |

During the annual budget process, which starts in September of each year, the Board of Directors may recommend a dues increase for the upcoming Fiscal Year in order to appropriately accommodate any increases in general operating costs.

- The historical annual increase for dues assessments for general operations is usually between 0 – 1%.

- The historical annual increase for dues assessments for the reserve fund for capital improvements

- is between 0 – 3%.

| Annual Fiscal Year Budget | Annual Capital Improvement Plan |

| 2023 Budget Summary | Capital-Improvement-Plan |

Future Dues Assessments Methodology

Future Dues Assessments Methodology

In 2013, prior to any new UMU projects entering the park, the Board of Directors established an “as-is, pre-UMU” baseline for annual operating expenses for Innsbrook (referred as the Expense Stop). The official Expense Stop established by the Board of Directors was $900,000.

Any operating costs in excess of the Expense Stop are then allocated equitably amongst all Property Owners using the following millage rate methodology:

Overage Calculation

Actual Operating Expenses (current year) – Expense Stop

Millage Rate

Overage ÷ Total/Aggregate Assessed Value of All Innsbrook Properties (current year)

Additional Dues Assessment per Property

Millage Rate Property × Property Tax Assessment (current year)

Additional Dues Assessment per Net Acre

Additional Dues Assessment ÷ Total Net Acres for subject property

EXAMPLE: 7 net acre property in Innsbrook, $10,000,000 Henrico Tax Assessment

Step 1

Overage Calculation

$950,000 (actual Operating Expenses for fiscal year) – $900,000 (Expense Stop) = $50,000 (over Expense Stop for fiscal year)

Step 2

Millage Rate Calculation

$50,000 (over Expense Stop for fiscal year) ÷ $700,000,000 (current calendar year aggregate tax assessment for all Innsbrook properties) = 0.0071429% standard Millage Rate for fiscal year

Step 3

Total Additional Dues Assessment per property

0.0071429% (Millage Rate) × $10,000,000 (current year tax assessment) * = $714.29 Additional Dues Assessment

Step 4

Total Additional Dues Assessment per Net Acre per property

$714.29 Additional Dues Assessment ÷ 7 (Net Acres for subject property) = $102.04 Additional Dues Assessment

Step 5

Total Dues Assessment per Net Acre

Base Dues Assessment per Net Acre = $1,584

- $1,254/net acre = Operating

- $330/net acre = Reserve Fund/Capital Improvements

Additional Dues Assessment in excess of Expense Stop = $102.04

- $1,254/net acre = Operating

- $330/net acre = Reserve Fund/Capital Improvements

Total Dues Assessment per Net Acre = $1,686.04

The Board of Directors has the sole authority to elect whether or not to implement the Expense Stop and Additional Dues Assessment methodology for any given Fiscal Year. This methodology would apply to all owners of Commercial Offices, Retail Shoppes, Hotels and Residential Units within Innsbrook Corporate Center.

For a specific example of allocation of expenses in excess of the Expense Stop.